Read in Hindi: बजट 2018-19: कुल खर्च 24.42 लाख करोड़ रुपये से अधिक होने का अनुमान

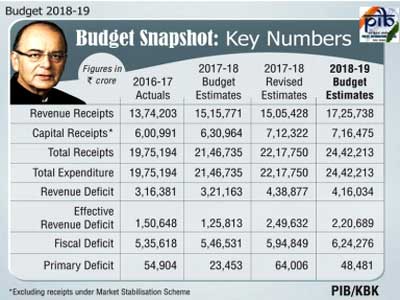

Jaitely said that the government’s commitment is substantiated by increase in expenditure of Rs.2,24,463 crores over RE (2017-18). He said the aim is for a reduction of Fiscal Deficit by 0.2% of GDP over RE 2017-18. He projected a Fiscal Deficit of 3.3% of GDP for the year 2018-19.

Finance Minister Arun Jaitley said that the present Government assumed office in May, 2014 when fiscal deficit was running at very high levels. Fiscal Deficit for 2013-14 was 4.4% of GDP. He said that the present Government has embarked on the path of consistent fiscal reduction and consolidation in 2014. Fiscal Deficit was brought down to 4.1% in 2014-15 to 3.9% in 2015-16, and to 3.5% in 2016-17. Revised Fiscal Deficit estimates for 2017-18 are Rs.5.95 lakh crore at 3.5% of GDP.

FM said that in order to impart unquestionable credibility to the Government’s commitment for the revised fiscal glide path, he is proposing to accept key recommendations of the Fiscal Reform and Budget Management (FRBM) Committee relating to adoption of the Debt Rule and to bring down the Central Government’s Debt to GDP ratio to 40%.

Government has also accepted the recommendation to use Fiscal Deficit target as the key operational parameter. Necessary amendment proposals are included in the Finance Bill, Jaitley pointed out.

General Budget 2018-19 Highlights…

Finance Minister Shri Arun Jaitley presents general Budget 2018-19 in Parliament. Highlights of the budget are as follow…

# Budget guided by mission to strengthen agriculture, rural development, health, education, employment, MSME and infrastructure sectors.

# Government says, a series of structural reforms will propel India among the fastest growing economies of the world. Country firmly on course to achieve over 8 % growth as manufacturing, services and exports back on good growth path.

# MSP for all unannounced kharif crops will be one and half times of their production cost like majority of rabi crops: Institutional Farm Credit raised to 11 lakh crore in 2018-19 from 8.5 lakh crore in 2014-15.

# 22,000 rural haats to be developed and upgraded into Gramin Agricultural Markets to protect the interests of 86% small and marginal farmers.

# “Operation Greens” launched to address price fluctuations in potato, tomato and onion for benefit of farmers and consumers.

# Two New Funds of Rs10,000 crore announced for Fisheries and Animal Husbandary sectors; Re-structured National Bamboo Mission gets Rs.1290 crore.

# Loans to Women Self Help Groups will increase to Rs.75,000 crore in 2019 from 42,500 crore last year.

# Higher targets for Ujjwala, Saubhagya and Swachh Mission to cater to lower and middle class in providing free LPG connections, electricity and toilets.

# Outlay on health, education and social protection will be 1.38 lakh crore. Tribal students to get Ekalavya Residential School in each tribal block by 2022. Welfare fund for SCs gets a boost.

# World’s largest Health Protection Scheme covering over 10 crore poor and vulnerable families launched with a family limit upto 5 lakh rupees for secondary and tertiary treatment.

# Fiscal Deficit pegged at 3.5 %, projected at 3.3 % for 2018-19.

# More concessions for International Financial Services Centre (IFSC), to promote trade in stock exchanges located in IFSC.

# To control cash economy, payments exceeding Rs.10,000 in cash made by trusts and institutions to be disallowed and would be subject to tax.

# Tax on Long Term Capital Gains exceeding Rs.1 lakh at the rate of 10 percent, without allowing any indexation benefit. However, all gains up to 31st January, 2018 will be grandfathered.

# Proposal to introduce tax on distributed income by equity oriented mutual funds at the rate of 10 percent.

# Proposal to increase cess on personal income tax and corporation tax to 4 percent from present 3 percent.

# Proposal to roll out E-assessment across the country to almost eliminate person to person contact leading to greater efficiency and transparency in direct tax collection.

# Proposed changes in customs duty to promote creation of more jobs in the country and also to incentivise domestic value addition and Make in India in sectors such as food processing, electronics, auto components, footwear and furniture.

Related Items

Budget sows seeds for a flourishing agricultural future

Union Budget outlines a significant push towards nuclear energy

Understand Union Budget 2025-26 in simple points…