Union Minister for Finance and Corporate Affairs Nirmala Sitharaman presented the Union Budget 2025-26 in Parliament on the first day of February. We have compiled it in simple points for you. Have a look… (हिंदी में पढ़ें : आम बजट को सबसे आसान भाषा में यहां समझें...)

• The total receipts other than borrowings and the total expenditure are estimated at ₹ 34.96 lakh crore and ₹ 50.65 lakh crore respectively.

• The net tax receipts are estimated at ₹ 28.37 lakh crore.

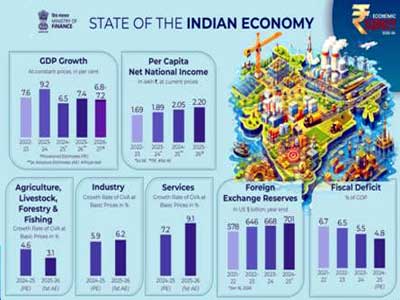

• The fiscal deficit is estimated to be 4.4 per cent of GDP.

• The gross market borrowings are estimated at ₹ 14.82 lakh crore.

• Capex Expenditure of ₹11.21 lakh crore i.e. 3.1 per cent of GDP, earmarked in FY2025-26.

• Prime Minister Dhan-Dhaanya Krishi Yojana is to be launched in partnership with the states, covering 100 districts with low productivity, moderate crop intensity and below-average credit parameters, to benefit 1.7 crore farmers.

• A comprehensive multi-sectoral programme to be launched in partnership with states to address under-employment in agriculture through skilling, investment, technology, and invigorating the rural economy.

• Government to launch a 6-year ‘Mission for Aatmanirbharta in Pulses’ with a focus on Tur, Urad and Masoor. NAFED and NCCF to procure these pulses from farmers during the next four years.

• A comprehensive programme to promote production, efficient supplies, processing, and remunerative prices for farmers to be launched in partnership with states.

• A Makhana Board to be established to improve production, processing, value addition, and marketing of makhana.

• A National Mission on High Yielding Seeds to be launched aiming at strengthening the research ecosystem, targeted development and propagation of seeds with high yield, and commercial availability of more than 100 seed varieties.

• Government to bring a framework for sustainable harnessing of fisheries from the Indian Exclusive Economic Zone and High Seas, with a special focus on the Andaman & Nicobar and Lakshadweep Islands.

• A 5-year mission announced to facilitate significant improvements in productivity and sustainability of cotton farming and promote extra-long-staple cotton varieties.

• The loan limit under the Modified Interest Subvention Scheme is to be enhanced from ₹3 lakh to ₹5 lakh for loans taken through the KCC.

• A plant with an annual capacity of 12.7 lakh metric tons to be set up at Namrup, Assam.

• The investment and turnover limits for the classification of all MSMEs are to be enhanced to 2.5 and 2 times respectively.

• Customized Credit Cards with ₹5 lakh limit for micro-enterprises registered on ूपा Udyam portal, 10 lakh cards to be issued in the first year.

• A new Fund of Funds, with expanded scope and a fresh contribution of ₹10,000 crore to be set up.

• A new scheme for 5 lakh women, Scheduled Castes and Scheduled Tribes first-time entrepreneurs to provide term loans up to ₹2 crore in the next five years announced.

• To enhance the productivity, quality and competitiveness of India’s footwear and leather sector, a focus product scheme was announced to facilitate employment for 22 lakh persons, generate turnover of ₹4 lakh crore and exports of over ₹1.1 lakh crore.

• A scheme to create high-quality, unique, innovative, and sustainable toys, making India a global hub for toys announced.

• A National Institute of Food Technology, Entrepreneurship and Management to be set up in Bihar.

• A National Manufacturing Mission covering small, medium and large industries for furthering ‘Make in India’ announced.

• 50,000 Atal Tinkering Labs to be set up in Government schools in the next five years.

• Broadband connectivity to be provided to all Government secondary schools and primary health centres in rural areas under the Bharatnet project.

• Bharatiya Bhasha Pustak Scheme announced to provide digital-form Indian language books for school and higher education.

• Five National Centres of Excellence for Skilling to be set up with global expertise and partnerships to equip our youth with the skills required for ‘Make for India, Make for the World’ manufacturing.

• Additional infrastructure to be created in the five IITs started after 2014 to facilitate education for 6,500 more students.

• A Centre of Excellence in Artificial Intelligence for education to be set up with a total outlay of ₹500 crore.

• 10,000 additional seats to be added in medical colleges and hospitals next year, adding to 75000 seats in the next five years.

• Government to set up Day Care Cancer Centres in all district hospitals in the next three years, 200 Centres in 2025-26.

• A scheme for socio-economic upliftment of urban workers to help them improve their incomes and have sustainable livelihoods announced.

• PM SVANidhi Scheme to be revamped with enhanced loans from banks, UPI-linked credit cards with ₹30,000 limit, and capacity-building support.

• Government to arrange for identity cards, registration on the e-Shram portal and healthcare under PM Jan Arogya Yojna, for gig-workers.

• Infrastructure-related ministries to come up with a 3-year pipeline of projects in PPP mode, States also encouraged.

• An outlay of ₹1.5 lakh crore was proposed for the 50-year interest-free loans to states for capital expenditure and incentives for reforms.

• Second Plan for 2025-30 to plough back capital of ₹10 lakh crore in new projects announced.

• An Urban Challenge Fund of ₹1 lakh crore was announced to implement the proposals for ‘Cities as Growth Hubs’, ‘Creative Redevelopment of Cities’ and ‘Water and Sanitation’, with allocation of ₹10,000 crore proposed for 2025-26.

• Amendments to the Atomic Energy Act and the Civil Liability for Nuclear Damage Act to be taken up.

• Nuclear Energy Mission for research & development of Small Modular Reactors with an outlay of ₹20,000 crore to be set up, Five indigenously developed SMRs to be operational by 2033.

• The Shipbuilding Financial Assistance Policy to be revamped. Large ships above a specified size are to be included in the infrastructure harmonized master list.

• A Maritime Development Fund with a corpus of ₹25,000 crore to be set up, with up to 49 per cent contribution by the Government, and the balance from ports and the private sector.

• A modified UDAN scheme was announced to enhance regional connectivity to 120 new destinations and carry four crore passengers in the next 10 years. Also to support helipads and smaller airports in hilly, aspirational, and North East region districts.

• Greenfield airports announced in Bihar, in addition to the expansion of the capacity of Patna airport and a brownfield airport at Bihta.

• Financial support for the Western Koshi Canal ERM Project in Bihar.

• A policy for recovery of critical minerals from tailings to be brought out.

• SWAMIH Fund of ₹15,000 crores aimed at expeditious completion of another one lakh dwelling units, with contributions from the Government, banks and private investors announced.

• Top 50 tourist destination sites in the country to be developed in partnership with states through a challenge mode.

• ₹20,000 crore to be allocated to implement the private sector-driven Research, Development and Innovation initiative announced in the July Budget.

• Deep Tech Fund of Funds to be explored to catalyze the next generation startups.

• 10,000 fellowships for technological research in IITs and IISc with enhanced financial support.

• 2nd Gene Bank with 10 lakh germplasm lines to be set up for future food and nutritional security.

• A National Geospatial Mission was announced to develop foundational geospatial infrastructure and data.

• A Gyan Bharatam Mission for survey, documentation and conservation of our manuscript heritage with academic institutions, museums, libraries and private collectors to be undertaken to cover more than 1 crore manuscripts announced.

• An Export Promotion Mission, with sectoral and ministerial targets, driven jointly by the Ministries of Commerce, MSME, and Finance to be set up.

• ‘BharatTradeNet’ for international trade to be set up as a unified platform for trade documentation and financing solutions.

• A national framework to be formulated as guidance to states for promoting Global Capability Centres in emerging tier-2 cities.

• The FDI limit for the insurance sector to be raised from 74 to 100 per cent, for those companies which invest the entire premium in India.

• NaBFID to set up a ‘Partial Credit Enhancement Facility’ for corporate bonds for infrastructure.

• Public Sector Banks to develop a ‘Grameen Credit Score’ framework to serve the credit needs of SHG members and people in rural areas.

• A forum for regulatory coordination and development of pension products to be set up.

• A High-Level Committee for Regulatory Reforms to be set up for a review of all non-financial sector regulations, certifications, licenses, and permissions.

• An Investment Friendliness Index of States to be launched in 2025 to further the spirit of competitive cooperative federalism announced.

• The Jan Vishwas Bill 2.0 to decriminalize more than 100 provisions in various laws.

• No personal income tax payable up to an income of Rs.12 lakh, i.e. average income of Rs.1 lakh per month other than special rate income such as capital gains, under the new regime. This limit will be Rs.12.75 lakh for salaried taxpayers, due to a standard deduction of Rs.75,000. The new structure will substantially reduce the taxes of the middle class and leave more money in their hands, boosting household consumption, savings and investment.

• The new Income-Tax Bill to be clear and direct in text to make it simple to understand for taxpayers and tax administration, leading to tax certainty and reduced litigation. Revenue of about ₹ 1 lakh crore in direct taxes will be forgone.

• Rationalization of Tax Deduction at Source by reducing the number of rates and thresholds above which TDS is deducted. The limit for a tax deduction on interest for senior citizens doubled from the present Rs.50,000 to Rs.1 lakh. The annual limit of Rs.2.40 lakh for TDS on rent increased to Rs.6 lakh.

• The threshold to collect tax at source on remittances under RBI’s Liberalized Remittance Scheme increased from Rs.7 lakh to Rs.10 lakh. The provisions of the higher TDS deduction will apply only in non-PAN cases. Decriminalization for the cases of delay of payment of TCS up to the due date of filing statement.

• Reduction of compliance burden for small charitable trusts or institutions by increasing their period of registration from five years to 10 years.

• The benefit of claiming the annual value of self-occupied properties as nil will be extended for two such self-occupied properties without any condition.

• Introduction of a scheme for determining the arm's length price of international transactions for a block period of three years.

• Expansion of the scope of safe harbour rules to reduce litigation and provide certainty in international taxation.

• Exemption of withdrawals made from the National Savings Scheme by individuals on or after the 29th of August, 2024. Similar treatment to NPS Vatsalya accounts as is available to normal NPS accounts, subject to overall limits.

• Presumptive taxation regime for non-residents who provide services to a resident company that is establishing or operating an electronics manufacturing facility.

• Introduction of a safe harbour for tax certainty for non-residents who store components for supply to specified electronics manufacturing units.

• The benefits of the existing tonnage tax scheme to be extended to inland vessels registered under the Indian Vessels Act, 2021 to promote inland water transport in the country.

• Extension of the period of incorporation by five years to allow the benefit available to start-ups incorporated before April 1, 2030.

• Certainty of taxation on the gains from securities to Category I and Category II AIFs which are undertaking investments in infrastructure and other such sectors.

• Extension of the date of making investments in Sovereign Wealth Funds and Pension Funds by five more years, to 31st March 2030, to promote funding from them to the infrastructure sector.

• Union Budget 2025-26 proposes to remove seven tariff rates. This is over and above the seven tariff rates removed in the 2023-24 budget. After this, there will be only eight remaining tariff rates including the ‘zero’ rate. Apply appropriate cess to broadly maintain effective duty incidence except on a few items, where such incidence will reduce marginally. Levy not more than one cess or surcharge. Therefore, the Social Welfare Surcharge on 82 tariff lines that are subject to a cess, is exempted. Revenue of about ₹ 2600 crore in indirect taxes will be forgone.

• 36 lifesaving drugs and medicines fully exempted from Basic Customs Duty.

• Six lifesaving medicines to attract concessional customs duty of five per cent.

• Specified drugs and medicines under Patient Assistance Programmes run by pharmaceutical companies fully exempted from BCD; 37 more medicines added along with 13 new patient assistance programmes.

• Cobalt powder and waste, the scrap of lithium-ion battery, Lead, Zinc and 12 more critical minerals are fully exempted from BCD.

• Two more types of shuttle-less looms fully exempted textile machinery.

• BCD on Interactive Flat Panel Display increased from 10 per cent to 20 per cent.

• BCD reduced to 5 per cent on Open Cells and other components. BCD on parts of Open Cells exempted.

• 35 additional capital goods for EV battery manufacturing, and 28 additional capital goods for mobile phone battery manufacturing exempted.

• Exemption of BCD on raw materials, components, consumables or parts for the manufacture of ships extended for another ten years. The same dispensation to continue for ship breaking.

• BCD reduced from 20 per cent to 10 per cent on carrier-grade ethernet switches.

• Time for Handicraft Goods export extended from six months to one year, further extendable by another three months, if required. Nine items were added to the list of duty-free inputs.

• BCD on Wet Blue leather is fully exempted in the Leather sector. Crust leather is exempted from 20 per cent export duty.

• BCD reduced from 30 per cent to 5 per cent on Frozen Fish Paste for the manufacture and export of its analogue products.

• BCD reduced from 15 per cent to 5 per cent on fish hydrolysate for the manufacture of fish and shrimp feeds.

• Railways MROs to benefit similarly to the aircraft and ships MROs in terms of import of repair items. The time limit extended for the export of such items from six months to one year and made further extendable by one year.

• A new provision was introduced to enable importers or exporters, after clearance of goods, to voluntarily declare material facts and pay duty with interest but without penalty

Related Items

How the Supreme Court rewrote itself in 2025…

2025: A Defining Year for Indian Growth…

Extra-marital affairs fuel deadly violence