India is among the world’s fastest-growing major economies and is well-positioned to sustain this momentum. With the ambition of attaining high middle-income status by 2047- the centenary year of its independence- the country is building on strong foundations of economic growth, structural reforms, and social progress.

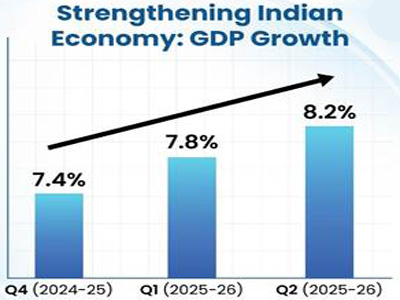

With a GDP valued at USD 4.18 trillion, India has surpassed Japan to become the world’s fourth-largest economy and is poised to displace Germany from the third rank in the next 2.5 to 3 years with a projected GDP of USD 7.3 trillion by 2030. The growth momentum further surprised on the upside, with GDP expanding to a six-quarter high in Q2 of 2025-26, reflecting India’s resilience amid persistent global trade uncertainties. Domestic drivers-led by robust private consumption-played a central role in supporting this expansion.

High-frequency indicators point to sustained economic activity: inflation remains below the lower tolerance threshold, unemployment is on a declining trajectory, and export performance continues to improve. Furthermore, financial conditions have stayed benign, with strong credit flows to the commercial sector, while demand conditions remain firm, supported by a further strengthening of urban consumption.

India’s real GDP grew 8.2 per cent in Q2 FY 2025-26, up from 7.8 per cent in the previous quarter and 7.4 per cent in Q4 of 2024-25, led by resilient domestic demand amidst global trade and policy uncertainties. Real gross value added expanded by 8.1 per cent, catalysed by buoyant industrial and services sectors.

The RBI revised India’s GDP growth forecast for FY 2025-26 upwards to 7.3 per cent from the earlier estimate of 6.8 per cent. India’s domestic growth is on an upward trajectory owing to multiple factors such as robust domestic demand, income tax and GST rationalisation, softer crude oil prices, front-loading of Government capital expenditure, CAPEX, along with facilitative monetary and financial conditions, supported by benign inflation.

Looking ahead, domestic drivers- favourable agricultural prospects, the sustained effects of GST rationalisation, benign inflation, and the strong balance sheets of corporates and financial institutions- coupled with supportive monetary and financial conditions, are expected to continue bolstering the economic activity. External factors such as services exports are projected to remain robust, while the swift conclusion of current trade and investment negotiations offers additional upside potential. Ongoing reforms are likely to further enable growth prospects. The present macro-economic situation presents a rare ‘goldilocks period’ of high growth and low inflation.

Employment is the critical bridge between growth and prosperity. In India, where ~26 per cent of the population is aged 10–24, this demographic moment presents a once-in-a-generation opportunity. As one of the world’s youngest nations, India’s growth story is being shaped by its ability to generate quality employment that productively absorbs its expanding workforce and delivers inclusive, sustainable growth.

Tracking employment trends is central to effective policymaking. To this end, the National Statistics Office launched the Periodic Labour Force Survey in 2017–18, offering timely insights into key labour indicators such as Labour Force Participation Rate, Worker Population Ratio, and Unemployment Rate. Notably, the 2025 PLFS shows a sharp decline in unemployment alongside marked improvements in participation and worker population ratios, signalling strengthening employment conditions.

Unemployment Rate is the proportion of the labour force that does not have employment and is seeking and/or available for work. Declining unemployment trends have persisted in India, indicating stronger workforce absorption into productive employment.

Unemployment closely mirrors the pace of economic activity- two sides of the same coin. As growth accelerates, higher production of goods and services creates greater demand for labour, leading to more job opportunities and lower unemployment. In this context, India’s declining unemployment reflects the strength of its economic momentum. With growth set to remain robust, India’s improving employment outcomes underscore the virtuous cycle between sustained growth and job creation.

In November 2025, the UR for persons aged 15 and above, following CWS, reduced to 4.8 per cent vs 5.4 per cent in October 2025, making it the lowest level since April 2025, 5.1 per cent. The decline is largely driven by a sharp fall in UR among women. UR among urban women declined from 9.7 per cent to 9.3 per cent, while for rural women, it declined from 4.0 per cent to 3.4 per cent. Overall, Rural UR fell to a new low of 3.9 per cent, while the urban UR decreased to 6.5 per cent.

With unemployment levels at record lows, the other two major indicators- LFPR & WPR, following CWS, also show promise of a strengthening and inclusive labour market.

LFPR is the percentage of persons in the labour force, i.e. working or seeking or available for work, in the population. A rising LFPR signals improving labour market engagement, as more people are entering the workforce. The overall LFPR for persons aged 15 and above rose to a seven-month high of 55.8 per cent in November 2025, and 54.2 per cent in June 2025.

WPR is the percentage of employed persons in the population. An increasing WPR is a key indicator of how many people are actually working and not unemployed. The overall WPR for persons aged 15 and above improved to 53.2 per cent in November 2025, up from 52.5 per cent in October and 51.2 per cent in June 2025.

These trends indicate strengthening labour market conditions, supported by gains in rural employment, rising female participation, and a gradual recovery in urban labour demand.

Consumer price index is the change in the price of a basket of goods and services that are typically purchased by specific groups of households. In 2025, India experienced an overall benign inflation environment. CPI inflation at the start of the year was 4.26 per cent in January and progressively softened through mid-year, before easing further to multi-year lows in the second half of the year.

In June, CPI inflation was reported at 2.10 per cent, well within the RBI's medium-term inflation target of four per cent Consumer Price Index, with a tolerance band of +/- 2 per cent. Headline CPI tracked a downward trajectory and reached historic lows around 0.25 per cent in October. The faster-than-anticipated decline in inflation was led by a correction in food prices, contrary to the usual trend witnessed during September and October. By November, CPI inflation edged up to 0.71 per cent, underscoring sustained price stability across broad consumption baskets.

RBI has also lowered its CPI inflation forecast for FY 2025–26 to 2.0 per cent, down from 2.6 per cent. CPI inflation for FY 2025-26 is projected at two per cent, comfortably within the RBI’s target range of 2–6 per cent. The quarterly inflation path for FY26 indicates 0.6 per cent in Q3, followed by 2.9 per cent in Q4. For FY27, it is projected at 3.9 per cent in Q1 and 4.0 per cent in Q2.

In the backdrop of evolving macroeconomic and financial developments, the RBI has reduced the policy repo rate by 25 basis points to 5.25 per cent with a neutral stance. It signals a growth-inflation balance, owing to a benign inflation outlook on both headline and core levels, that continues to provide the policy space to support the growth momentum. The overall inflation path in 2025 reaffirmed the effectiveness of India’s inflation-targeting framework, with CPI outcomes remaining comfortably within the RBI’s prescribed band throughout most of the year.

Wholesale price dynamics in 2025 also mirrored this trend of moderated inflation. The WPI inflation, which is a measure of average wholesale price movement for the economy, started the year positively at 2.31 per cent in January, supported by higher prices of manufacture of food products, food articles, other manufacturing, non-food articles and manufacture of textiles, etc.

From April’s low inflation of 0.85 per cent, WPI inflation oscillated between mild positive readings, culminating in a provisional -0.32 per cent annual WPI inflation rate in November 2025. These developments underscore the overall softening of price pressures at both retail and wholesale levels, contributing to a conducive macroeconomic environment for policy calibration and growth.

In January 2025, India’s foreign trade started the year on a solid footing with total exports, merchandise and services combined, estimated at US$74.97 billion, registering a growth of 9.72 per cent over January 2024. By June 2025, cumulative exports, April-June 2025, reached US$210.31 billion, up 5.94 per cent, while non-petroleum exports also maintained a positive momentum. These early and mid-year trends demonstrated steady export expansion and diversified external demand. By November 2025, the year’s trade trajectory reflected sustained external sector engagement.

India’s merchandise export performance in 2025 strengthened across major product groups and global markets. In the beginning, with exports valued at US$36.43 billion in January 2025, Indian exporters built on diversified demand conditions to sustain outward shipments throughout the year. Supported by strong contributions from sectors such as engineering goods, electronic goods, pharmaceuticals, gems & jewellery, and petroleum products, merchandise exports maintained a positive momentum, reflecting the competitiveness of Indian manufacturing and trade linkages with global value chains.

By November 2025, merchandise export value rose to US$38.13 billion, illustrating a consistent uptrend in external sector performance even during global trade disruptions.

The merchandise commodities which contributed to the resilient export growth in 2025 were cashew, marine products, other cereals, electronic goods, engineering goods and petroleum products, experiencing more than 10 per cent growth in 11 years.

By strengthening trade partnerships with the United Kingdom, Oman, and New Zealand in 2025, India broadened its global export footprint and enhanced access to emerging markets for its exports. Since January 2025, India has boosted its trade with China, Hong Kong, Brazil, Italy, France, Australia, the United Arab Emirates, Belgium, Germany and many others, while focusing on trade diversification.

Services exports remained a major pillar of resilience, expanding by 8.65 per cent to an estimated USD 270.06 billion in April-November 2025 from USD 248.56 billion in April-November 2024, underscoring India’s growing global competitiveness in computer services and business services. Overall, the export sector continues to reinforce India’s economic stability and growth outlook. As of November 28, 2025, India’s foreign exchange reserves stood at US$686.2 billion, providing a robust import cover of over 11 months.

India’s external sector remains resilient. With robust services exports and strong remittances, the Current Account Deficit moderated from 2.2 per cent of GDP in Q2: FY 2024-25 to 1.3 per cent in Q2:2025-26. Additionally, inward remittances increased by 10.7 per cent (y-o-y) in Q2:2025-26. The positive outlook of services exports, coupled with rising inward remittances, is expected to keep CAD modest during 2025-26.

On the external financing side, Foreign Direct Investment captured great momentum during the first half of the year. For the time frame April to September 2025-26 vis-à-vis the same period a year ago, while Gross FDI grew by 19.4 per cent to US$51.8 billion from US$43.4 billion, Net FDI increased by 127.6 per cent to US$7.7 billion from US$3.4 billion. The significant increase is attributed to a decline in repatriation, despite a rise in outward FDI.

Foreign Portfolio Investment to India recorded net outflows of US$0.7 billion in 2025-26 so far, April-December 03, due to outflows in the equity segment. Besides, flows under external commercial borrowings and non-resident deposit accounts moderated to US$6.2 billion during April-October 2025-26 from US$8.1 billion a year ago. Non-resident deposits recorded net inflows of US$6.1 billion in April-September 2025-26, lower than US$10.2 billion in the same period last year.

India’s growth outlook remains buoyant, with global and domestic institutions upgrading their assessments on the back of strong economic fundamentals. Reflecting broad-based momentum across key sectors, the Reserve Bank of India revised its GDP growth projection for FY 2025–26 upward from 6.8 per cent to 7.3 per cent.

International agencies have echoed this optimism: the World Bank projects 6.5 per cent growth in 2026; Moody’s expects India to remain the fastest-growing G20 economy with growth of 6.4 per cent in 2026 and 6.5 per cent in 2027; the IMF has raised its projections to 6.6 per cent for 2025 and 6.2 per cent for 2026; the OECD forecasts 6.7 per cent growth in 2025 and 6.2 per cent in 2026; S&P anticipates growth of 6.5 per cent in the current fiscal and 6.7 per cent in the next; the Asian Development Bank has lifted its 2025 forecast to 7.2 per cent; and Fitch has raised its FY26 projection to 7.4 per cent on stronger consumer demand.

Together, sustained international confidence along with robust domestic demand, falling unemployment, and easing inflation, position the country well to advance steadily towards its 2047 development goals.

Related Items

Indus Towers, a growth story with hidden vulnerabilities...

Should India's small rivers and streams be left to die?

How India manages a ‘Multipolar World'…!