1. Analysis of your finances

To form a long-term friendship with your finances, you need to know your finances well. By analyzing your finances, you get a clear picture of your capacity to fulfill your financial goals, savings, and spending habits. To get this objective, record your every expense daily and analyze your expenditures. Make a list of items before going shopping and stick to it.

2. Seek financial advice

Financial Advisers can help you make the right investment decision, at the right moment. Seeking financial advice can also help you overcome investment classes and bust myths.

3. Plan your Taxes in advance

By planning your Taxes in advance, you can integrate your Tax saving goal with various other financial goals. That can be done quickly with the help of Equity Linked Savings Schemes. However, you might miss this change by planning your Taxes at the last moment.

4. Invest in Mutual Funds

Mutual Funds schemes are designed to fulfill specific financial goals. You can choose funds that suit your risk profile. In addition to returns, Mutuals Funds also offer many benefits like rupee cost averaging, compounding, investment discipline, and risk diversification.

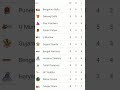

5. Review your Portfolio

Markets and government policies keep changing from time to time. It would be best if you were sure that you are making appropriate investments to reach your goals. Therefore, You should review your portfolio regularly.

Related Items

‘Trump Tariffs’ could hamper US manufacturing investment

Populist governments deter foreign investment, research finds

Top three ways to review your Mutual Fund portfolio