Across generations, Indian families have saved carefully through opening bank accounts, purchasing insurance policies, investing in mutual funds, earning dividends from shares and setting aside money for retirement. These financial decisions are taken with a hope and responsibility, often to secure children’s education, support healthcare needs, and ensure dignity in old age.

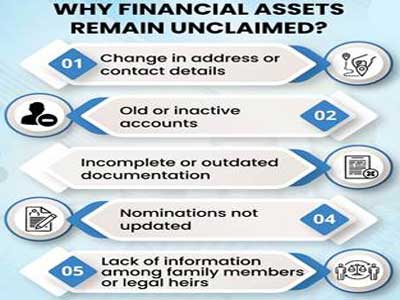

Yet, over time, a significant portion of these hard-earned savings has remained unclaimed. The money has not vanished, nor has it been misused. It lies safely with regulated financial institutions, separated from its rightful owners due to a lack of awareness, outdated records, changes in residence, or missing documentation. In many cases, families are simply unaware that such assets exist.

Read in Hindi: भूली हुई वित्तीय परिसंपत्तियां वापस पाना अब हुआ आसान...

‘Your Money, Your Right’ initiative is a nationwide effort to reconnect citizens with these forgotten financial assets and ensure that money that belongs to individuals and families ultimately finds its way back to them.

Unclaimed financial assets arise when money held with financial institutions is not claimed by the account holder or their legal heirs for a prolonged period. Such assets include, Bank deposits such as savings accounts, current accounts, fixed deposits and recurring deposits that have not been operated for ten years or more; Insurance policy proceeds that remain unpaid beyond the due date; Mutual fund redemption proceeds or dividends that could not be credited due to reasons such as change in bank account, bank account closure, incomplete bank account in records etc.; Dividends and shares that remain unclaimed and are transferred to statutory authorities; as well as Pension and retirement benefits that are not claimed within the normal course.

In most cases, assets may become unclaimed because of routine life events such as migration for work, changes in contact details, closure of old bank accounts, or lack of information among family members and legal heirs.

To address this challenge in a structured and citizen-centric manner, the government launched the ‘Your Money, Your Right’ initiative in October 2025 as a nationwide awareness and facilitation campaign. The initiative is coordinated by the Department of Financial Services, Ministry of Finance, in collaboration with key financial sector fund regulators, including: Reserve Bank of India, Insurance Regulatory and Development Authority of India, Securities and Exchange Board of India, Investor Education and Protection Fund Authority, and Pension Fund Regulatory and Development Authority.

The central objective is to help citizens identify, access and reclaim financial assets that legally belong to them, using simple processes and transparent systems. The volume of unclaimed financial assets in India is significant and spans multiple segments of the formal financial system. Indicative estimates suggest that Indian banks together hold around ₹78,000 crore in unclaimed deposits. Unclaimed insurance policy proceeds are estimated at nearly ₹14,000 crore, while unclaimed amounts in mutual funds are about ₹3,000 crore. In addition, unclaimed dividends account for around ₹9,000 crore.

Together, these amounts underline the scale of unclaimed savings belonging to citizens that continue to remain unused, despite being securely held within the financial system.

Unclaimed money is more than a financial statistic. For households, it may result in restricted or deferred access to funds needed for education, healthcare, livelihood support or emergencies. For senior citizens, it could involve pensions or insurance benefits that provide essential financial security.

At a systemic level, unclaimed assets weaken the connection between citizens and the formal financial system. When people are unable to access money that belongs to them, it affects trust, participation and confidence. Addressing this issue with the ‘Your Money, Your Right’ initiative strengthens not only household finances but also the credibility and inclusiveness of financial institutions.

The UDGAM portal, developed by the Reserve Bank of India, provides a central search facility for unclaimed bank deposits across participating banks in a centralised manner. While claims are settled by the respective banks, the portal helps citizens identify where unclaimed balances exist.

If a bank deposit remains unclaimed for ten years or more, it is transferred to the Depositor Education and Awareness Fund. However, the money still belongs to the customer, and there is no time limit for the customer or their legal heirs to claim it.

The Bima Bharosa portal enables individuals to trace unclaimed insurance policy proceeds. It allows policyholders, nominees and legal heirs to check whether any insurance amounts are due to them by providing links to the enquiry pages of insurers.

An insurance amount is treated as unclaimed when it remains unpaid beyond twelve months from the due date. Insurance proceeds that remain unclaimed for more than ten years are transferred to the Senior Citizens’ Welfare Fund maintained by the Government. Such a transfer does not affect ownership rights, and beneficiaries continue to retain the right to claim the amount, up to 25 years from the date of transfer.

Policyholders, nominees or legal heirs may approach the concerned insurer to initiate claims even after transfer to the SCWF, in accordance with prescribed procedures. There is no fee for claiming unclaimed insurance proceeds.

The framework also encourages preventive measures, including updating contact details, registering and updating nominations, informing family members about insurance policies, and maintaining physical or digital records of policy documents, including through platforms such as DigiLocker. The policies can also be linked to Aadhaar and PAN for easy identification.

The Mutual Fund Investment Tracing and Retrieval Assistant, hosted on MF Central, enables investors to trace unclaimed and inactive mutual fund investments. The platform allows investors to identify the mutual fund in which such investments may be held, using the prescribed search parameters. The folio number is a unique identification number provided by mutual fund institutions to their investors in order to track their assets in a certain scheme.

Mutual fund amounts remain unclaimed when redemption, maturity proceeds, or dividends are not credited to the investor’s bank account due to reasons such as changes or closure of bank accounts, incomplete records, outdated contact details, or pending KYC compliance.

In such cases, the money is not lost; on the due date, it is transferred to designated unclaimed schemes, where it remains until it is claimed. Additionally, a mutual fund folio is treated as inactive if the investor does not make any transactions for ten years, even though the unit balance is available in the folio.

MITRA facilitates the identification of unclaimed or inactive investments, after which investors may contact the concerned Asset Management Company or Registrar and Transfer Agent to initiate the claim process.

The framework also emphasises preventive measures, encouraging investors to keep KYC details, bank account information and contact records updated, and to regularly review account statements to avoid future instances of unclaimed investments.

Unclaimed dividends and shares are transferred by companies to the Investor Education and Protection Fund Authority after remaining unpaid or unclaimed for a continuous period of seven years. The IEPFA portal provides a search facility that allows individuals to trace unclaimed dividends, shares or deposits by entering details such as PAN, Name or Company Name and Demat ID/Folio Number.

There is no charge for filing a claim with the IEPFA, and there is no specific time limit for claiming amounts transferred to the Fund. The rightful claimant can apply for a refund at any point after the transfer has been made.

The ‘Your Money, Your Right’ initiative places strong emphasis on direct citizen outreach, combining digital platforms with structured on-ground engagement to ensure wide and inclusive coverage across the country.

Launched in October 2025, the initiative was implemented as a three-month nationwide drive from October to December 2025, covering every State and Union Territory. The campaign is anchored in the 3A Framework — Awareness, Accessibility and Action, to enable citizens to identify, access and reclaim their rightful savings through simple and transparent processes.

From October until 19th December 2025, facilitation camps were organised in 668 districts. These camps witnessed active participation from public representatives, district administrations, and officials from banks, insurance companies and other financial institutions, ensuring coordinated and effective service delivery at the local level.

The camps were conducted through State-Level Bankers’ Committees and State-Level Insurance Committees, in coordination with lead district banks and local administrations.

Citizens were assisted through helpdesks and digital kiosks to check for unclaimed financial assets and initiate claims conveniently. They were also encouraged to enrol under financial inclusion schemes and complete KYC and re-KYC formalities, thereby strengthening their link with the formal financial system.

District-level implementation translated national objectives into measurable outcomes at the local level. Dormant and unclaimed financial accounts were identified, claims were initiated, and funds were restored to beneficiaries in multiple instances, including through on-the-spot settlements during outreach activities. The participation of banks, insurance companies and other financial institutions on a common platform enabled coordinated service delivery, simplified citizen interaction and reduced procedural delays.

The coordinated efforts of Government departments, regulators and financial institutions yielded tangible results during the course of the campaign. Nearly ₹2,000 crore was returned to rightful owners, reconnecting families with financial assets that had remained unclaimed for extended periods.

In addition to financial recovery, the initiative contributed to improved awareness around nominations, documentation and record-keeping, supporting more effective financial planning at the household level.

‘Your Money, Your Right’ is a focused and citizen-centric initiative that reconnects individuals and families with financial assets that rightfully belong to them. By combining awareness, simplified access and coordinated facilitation, the initiative addresses a long-standing gap in the financial system and ensures that unclaimed savings are identified and returned to their rightful owners.

At a broader level, the initiative strengthens trust in financial institutions, reinforces financial inclusion and promotes responsible financial practices. By ensuring that personal savings remain accessible, protected and transferable, ‘Your Money, Your Right’ contributes to a more transparent, responsive and citizen-first financial ecosystem.

Related Items

When IndiGo’s engines died, the whole rotten system crashed…

What to do with the shares of Mazagon Dock now...!

Reduce portfolio volatility, capture returns with this mutual fund…