Cabinet also decided to provide for adequate funds for meeting the recurring and non recurring expenses of the GST Council Secretariat, the entire cost for which shall be borne by the Central Government. The GST Council Secretariat shall be manned by officers taken on deputation from both the Central and State Governments.

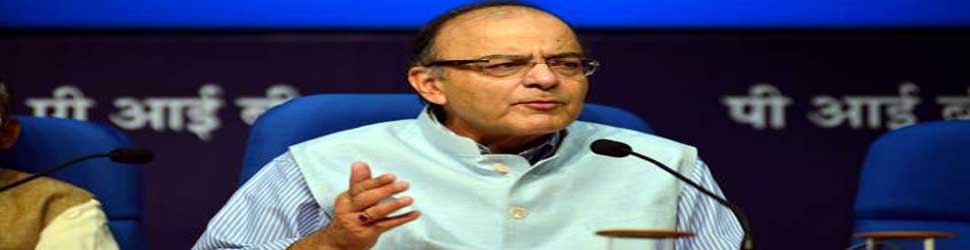

Finance Minister Arun Jaitley has also decided to call the First Meeting of the GST Council on 22nd and 23rd September in New Delhi.

The Constitution (One Hundred and Twenty-second Amendment) Bill, 2016, for introduction of Goods and Services Tax (GST) in the country was accorded assent by the President on 8th September and the same has been notified. As per Article 279A (1) of the amended Constitution, the GST Council has to be constituted by the President within 60 days of the commencement of Article 279A. The notification for bringing into force Article 279A with effect from 12th September was issued on 10th September.

As per Article 279A of the amended Constitution, the GST Council will be a joint forum of the Centre and the States. This Council shall consist of the following members namely: Union Finance Minister… Chairperson, The Union Minister of State, in-charge of Revenue of finance… Member, and, the Minister In-charge of finance or taxation or any other Minister nominated by each State Government… Members.

Council will make recommendations to the Union and the States on important issues related to GST, like the goods and services that may be subjected or exempted from GST, model GST Laws, principles that govern Place of Supply, threshold limits, GST rates including the floor rates with bands, special rates for raising additional resources during natural calamities / disasters, special provisions for certain States, etc.

Related Items

AMU Academic Council Reviews Special Centers Establishment

Pass Bar Council Test If You Want To Practice In Court

Cabinet Approves Motor Vehicle Amendment Bill To Make Roads Safe