Bengaluru: Solar Energy sector secured funding worth US$1.55 billion in the year 2023, nine percent lower than the US$1.7 billion raised in 2022. However, this space has witnessed US$1 billion in funding, with Sukhbir Agro Energy raising US$1 billion in its private equity round in January 2024 according to Tracxn report.

Tracxn, a market intelligence platform, has released its Geo Solar Energy Report, based on its extensive database, which provides a round-up of funding and other major developments in India’s solar energy space in 2023.

The majority of the funding in this space comes from late-stage rounds. However, a decline in late-stage investments led to a subsequent drop in overall funding in the year 2023. Companies in this space attracted late-stage funding worth US$1.3 billion in 2023, a 23 percent decrease from the US$1.7 billion raised in 2022.

A sharp surge was observed in early-stage funding, which rose six-fold to US$252 million in 2023 from US$39 million in 2022. Seed-stage funding in this space has raised a total of US$11.5 million in 2023, a growth of 58 percent compared to the US$7.26 million raised in 2022.

The solar energy sector in India has witnessed a total of 39 US$100 million+ rounds to date, out of which 12 have taken place in the last two years. No unicorns have emerged from this sector so far.

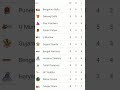

Among the cities, Delhi takes the lead in terms of total funding to date, followed by Gurgaon and Mumbai. Solar Energy companies based in Delhi have raised US$3.1 billion to date, followed by those based in Gurugram (US$2.7 billion) and Mumbai (US$2.3 billion).

There has been notable activity in terms of exits within this sector. The Indian solar energy sector has seen 43 acquisitions to date, of which 16 acquisitions were witnessed in the last few years, and 2024 has seen only one acquisition so far. Further, 49 companies have gone public to date, out of which three IPOs took place in 2023 and two in 2022.

IFC, Villgro, and DFC are the most active investors in the Indian Solar Energy space to date. CIIE, Social Alpha, and Villgro are the top seed-stage investors in this space, while Acumen, CIIE, and FMO are the top early-stage investors. Axis Bank, British International, and KKR are the top late-stage investors in this space.

The government of India has already started to focus on locally developing solar products by providing incentives worth more than US$3 billion in the last three years. States such as Gujarat, Rajasthan, Karnataka, and Tamil Nadu are already generating more than 9 MW of solar energy.

The Indian government has set a target of net zero emissions by 2070. It also plans to diversify 50 percent of its electricity requirement to renewable energy by the year 2030. The government is giving a push to the deployment of renewable sources of energy, especially solar, through policies and incentives.

The government also encourages 100 percent Foreign Direct Investment through the automatic route to promote solar energy within the country. These initiatives are expected to bolster solar energy companies and accelerate sectoral growth.

Related Items

Private sector has become the beating engine of India’s economy

Indian seafood export sector gets major boost from EU

Temple economy emerging as a parallel billion-dollar sector