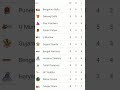

Nifty started the week on a sluggish note and traded in range with negative bias during the first four sessions during previous week, it bounced back taking support at the lower band of the last six week consolidation and posted strong gains on Fridays trade to close at an all time high of 6858.80.

The 30 share S&P BSE Sensex closed up by 590 points or 2.63% at 22994, while the NSE Nifty settled at 6858, up by 164 points or 2.45%.

Amid Nifty constituents, Reliance Industries, Axis Bank, ICICI Bank, BHEL, HDFC bank, Larsen & Toubro, Maruti, ONGC, Tata Steel and State Bank of India were top gainers while Bharti Airtel, HDFC, HCL Technology, Infosys, and Lupin were top draggers.

In the coming weeks, Nifty, 6650 is likely to act as major short term support being the bullish gap area formed on intra-day charts at the start of the April series and the lower band of the recent consolidation.

Nifty on the higher side a strong up move above previous week high of 6870 would put the index on course for an extended target of 7000-7050 levels in the near term being the measuring implication of the range breakout (6850-6650=200 points) added to the breakout level of 6850 (6850+200=7050) and also equality of preceding up leg (6432-6776=344 points) as projected from recent lows of 6650 (6650+344=6994).

Market is likely to see higher volatility next week as exit polls will be out early in the week after the 9th and final phase of Lok Sabha elections concludes on Monday, 12 May, and as election results will be out on 16 May.

Related Items

Air Travel: Deadly Negligence and Government Deceptions!

A unique market for the country's artisans at Prayagraj…

Evolving modern flesh trade market in Agra