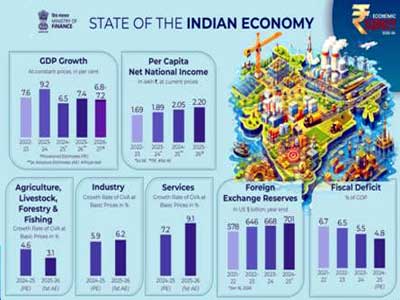

India’s real GDP is projected to grow between 6.5–7 per cent in 2024-25. The Indian economy recovered swiftly from the pandemic, with its real GDP in FY24 being 20 per cent higher than the pre-COVID, FY20 levels. This was stated by the Economic Survey 2023-24 presented in Parliament by the Union Minister of Finance and Corporate Affairs Nirmala Sitharaman.

The Survey points out that the domestic growth drivers have supported economic growth in FY24 despite uncertain global economic performance. It also adds that during the decade ending FY20, India grew at an average annual rate of 6.6 per cent, more or less reflecting the long-run growth prospects of the economy.

Read in Hindi: भारत की वास्तविक सकल घरेलू उत्पाद 6.5 से 7 फीसदी रहने का अनुमान

The Survey, however, cautions that any escalation of geopolitical conflicts in 2024 may lead to supply dislocations, higher commodity prices, reviving inflationary pressures and stalling monetary policy easing with potential repercussions for capital flows. This can also influence RBI’s monetary policy stance. The global trade outlook for 2024 remains positive, with merchandise trade expected to pick up after registering a contraction in volumes in 2023.

The Survey highlights that by leveraging the initiatives taken by the government and capturing the untapped potential in emerging markets; exports of business, consultancy and IT-enabled services can expand. Despite the core inflation rate being around three per cent, the RBI, with one eye on the withdrawal of accommodation and another on the US Fed, has kept interest rates unchanged for quite some time, and the anticipated easing has been delayed.

The Economic Survey says that India’s economy showed resilience to a gamut of global and external challenges as real GDP grew by 8.2 per cent in FY 24, exceeding the eight per cent mark in three out of four quarters of FY 24, driven by stable consumption demand and steadily improving investment demand.

The Survey underlines that the shares of the agriculture, industry and services sectors in overall GVA at current prices were 17.7 per cent, 27.6 per cent and 54.7 per cent respectively in FY24. GVA in the agriculture sector continued to grow, albeit at a slower pace, as the erratic weather patterns during the year and an uneven spatial distribution of the monsoon in 2023 impacted overall output.

Within the industrial sector, manufacturing GVA shrugged off a disappointing FY23 and grew by 9.9 per cent in FY24, as manufacturing activities benefitted from reduced input prices while catering to stable domestic demand. Similarly, construction activities displayed increased momentum and registered a growth of 9.9 per cent in FY24 due to the infrastructure build-out and buoyant commercial and residential real estate demand.

Various high-frequency indicators reflect the growth in the services sector. Both Goods and Services Tax collections and the issuance of e-way bills, reflecting wholesale and retail trade, demonstrated double-digit growth in FY24. Financial and professional services have been a major driver of growth during the pandemic, the survey added.

Gross Fixed Capital Formation continues to emerge as an important driver of growth. GFCF by private non-financial corporations increased by 19.8 per cent in FY23. There are early signs that the momentum in private capital formation has been sustained in FY24. As per data provided by Axis Bank Research, private investment across a consistent set of over 3,200 listed and unlisted non-financial firms has grown by 19.8 per cent in FY24.

Apart from private corporations, households have also been at the forefront of the capital formation process. In 2023, residential real estate sales in India were at their highest since 2013, witnessing a 33 per cent YoY growth, with a total sale of 4.1 lakh units in the top eight cities.

With cleaner balance sheets and adequate capital buffers, the banking and financial sector is well-positioned to cater to the growing financing needs of investment demand. Credit disbursal by scheduled commercial banks to industrial micro, small and medium enterprises and services continues to grow in double digits despite a higher base. Similarly, personal loans for housing have surged, corresponding to the increase in housing demand.

The Survey states that despite global supply chain disruptions and adverse weather conditions, domestic inflationary pressures moderated in FY24. After averaging 6.7 per cent in FY23, retail inflation declined to 5.4 per cent in FY24. This has been due to the combination of measures undertaken by the Government and the RBI. The Union Government undertook prompt measures such as open market sales, retailing in specified outlets, timely imports, reduced the prices of Liquified Petroleum Gas cylinders and implemented a cut in petrol and diesel prices. The RBI raised policy rates by a cumulative 250 bps between May 2022 and February 2023.

The Survey says, that against the global trend of widening fiscal deficit and increasing debt burden, India has remained on the course of fiscal consolidation. The fiscal deficit of the Union Government has been brought down from 6.4 per cent of GDP in FY23 to 5.6 per cent of GDP in FY24, according to provisional actuals data released by the Office of Controller General of Accounts.

The growth in gross tax revenue was estimated to be 13.4 per cent in FY24, translating into tax revenue buoyancy of 1.4. The growth was led by a 15.8 per cent growth in direct taxes and a 10.6 per cent increase in indirect taxes over FY23.

The Survey adds that broadly, 55 per cent of GTR accrued from direct taxes and the remaining 45 per cent from indirect taxes. The increase in indirect taxes in FY24 was mainly driven by a 12.7 per cent growth in GST collection. The increase in GST collection and E-way bill generation reflects increased compliance over time.

The capital expenditure for FY24 stood at ₹9.5 lakh crore, an increase of 28.2 per cent on a YoY basis, and was 2.8 times the level of FY20. The Government’s thrust on capex has been a critical driver of economic growth amidst an uncertain and challenging global environment. Spending in sectors such as road transport and highways, railways, defence services, and telecommunications delivers higher and longer impetuses to growth by addressing logistical bottlenecks and expanding productive capacities.

The Survey says it is also incumbent upon the private sector to take forward the momentum in capital formation on its own and in partnership with the Government. Their share in addition to the capital stock in terms of machinery and equipment, started growing robustly only since FY22, a trend that needs to be sustained on the strength of their improving bottom line and balance sheets to generate high-quality jobs.

The Survey points out that the State governments continued to improve their finances in FY24. Preliminary unaudited estimates of finances for a set of 23 states, published by the Comptroller and Auditor General of India, suggest that the gross fiscal deficit of these 23 states was 8.6 per cent lower than the budgeted figure of ₹9.1 lakh crore. This implies that fiscal deficit as a per cent of GDP for these states came in at 2.8 per cent as against a budgeted 3.1 per cent. The quality of spending by state governments improved, too, with state governments focusing on Capex as well.

The Union Government’s transfers to the states are highly progressive, with states with lower Gross State Domestic Product per capita receiving higher transfers relative to their GSDP.

The Survey highlights that the RBI’s vigil over the banking and financial system and its prompt regulatory actions ensure that the system can withstand any macroeconomic or systemic shock. Data from the RBI’s Financial Stability Report of June 2024 show that the asset quality of Scheduled commercial banks has improved, with the Gross Non-Performing Assets ratio declining to 2.8 per cent in March 2024, a 12-year low.

The profitability of SCBs remained steady, with the return on equity and return on assets ratios at 13.8 per cent and 1.3 per cent, respectively, as of March 2024. Macro stress tests also reveal that SCBs would be able to comply with minimum capital requirements even under severe stress scenarios. The soundness of the banking system will facilitate the financing of productive opportunities and lengthen the financial cycle, both of which are necessary to sustain economic growth.

The Survey highlights that on the external front, moderation in merchandise exports continued during FY24, mainly on account of weaker global demand and persistent geopolitical tensions. Despite that India's service exports have remained robust, reaching a new high of USD 341.1 billion in FY24. The exports in FY24 grew by 0.15 per cent, while the total imports declined by 4.9 per cent stated the survey.

Net private transfers, mostly comprising remittances from abroad, grew to USD 106.6 billion in FY24. As a result, the Current Account Deficit stood at 0.7 per cent of the GDP during the year, an improvement from the deficit of 2.0 per cent of GDP in FY23. The net FPI inflows stood at USD 44.1 billion during FY24 against net outflows in the preceding two years.

Overall, India’s external sector is being deftly managed with comfortable foreign exchange reserves and a stable exchange rate. Forex reserves as of the end of March 2024 were sufficient to cover 11 months of projected imports.

The Survey underscores that the Indian Rupee has also been one of the least volatile currencies among its emerging market peers in FY24. India’s external debt vulnerability indicators also continued to be benign. External debt as a ratio to GDP stood at a low level of 18.7 per cent as of the end of March 2024. The ratio of foreign exchange reserves to total debt stood at 97.4 per cent as of March 2024 as per the Economic Survey 2023-24.

The Survey points out that India’s social welfare approach has undergone a shift from an input-based approach to outcome-based empowerment. Government initiatives like providing free-of-cost gas connections under PM Ujjwala Yojana, building toilets under the Swacch Bharat Mission, opening bank accounts under Jan Dhan Yojana, building pucca houses under PM-AWAS Yojana have improved capabilities and enhanced opportunities for the underprivileged sections. The approach also involves the targeted implementation of reforms for last-mile service delivery to truly realise the maxim of “no person left behind”, the Survey added.

The Direct Benefit Transfer scheme and Jan Dhan Yojana-Aadhaar-Mobile trinity have been boosters of fiscal efficiency and minimization of leakages, with ₹36.9 lakh crore having been transferred via DBT since its inception in 2013.

The Survey says, the all-India annual unemployment rate has been declining since the pandemic and this has been accompanied by a rise in the labour force participation rate and worker-to-population ratio. From the gender perspective, the female labour force participation rate has been rising for six years, i.e., from 23.3 per cent in 2017-18 to 37 per cent in 2022-23, driven mainly by the rising participation of rural women.

On the global economic scenario the Survey says that after a year marked by global uncertainties and volatilities, the economy achieved greater stability in 2023. While uncertainty stemming from adverse geopolitical developments remained elevated, global economic growth was surprisingly robust.

The Survey states as per the World Economic Outlook, April 2024 of the International Monetary Fund, the global economy registered a growth of 3.2 per cent in 2023.

Related Items

Real GDP growth for FY27 is projected at 6.8-7.2 per cent

India’s ‘Unique’ Journey as a Republic…

India rises as a ‘Global Medical Travel Destination’