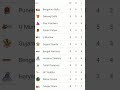

Firms with exclusive brokerage positions in their collaboration networks outshine their counterparts by an average margin of more than 7 per cent in crisis conditions, according to recent research conducted at ESMT Berlin.

The competitive advantage of exclusive brokers stems from their capacity to adapt quickly, and on their terms, when crisis erupts - unlike their peers trapped in more tightly-knit, constraining networks.

This finding emerges from a collaborative study by Matthew S Bothner, professor of strategy and Deutsche Telekom Chair holder at ESMT Berlin, together with Nghi Truong, an ESMT Berlin alumna now on the faculty of Sasin School of Management, alongside scholars at INSEAD and the City University of Hong Kong. The team explored the impact of crises – such as pandemics, geopolitical conflicts, and economic downturns – on the link between the structure of firms’ collaboration networks and their future performance.

The researchers took the bursting of the dot.com bubble as an experiment to study the impact of the crisis, examining the consequences for internet-active investment banks after the crisis hit. They analyzed data on US equity public offerings from 1985 to 2006, focusing on the equity market, which was significantly impacted.

In their analysis, the researchers distinguished between firms acting as uncontested hubs in hub-and-spoke networks and firms lacking these differentiated network positions.

Exclusive brokers can recombine the best ideas and opportunities from their otherwise disconnected collaborators – not having to contend with another “shadow broker” who might also wish to integrate these ideas and opportunities. This freedom to engage in uncontested brokerage is beneficial for navigating to a haven amidst a crisis. Legg Mason, a global asset management firm, offers a striking example of this successful navigation: Legg Mason’s exclusive brokerage position expanded vividly in the wake of the dot.com crisis, and its year-over-year performance increased by more than 20 per cent.

More generally, the analysis showed that exclusive brokers demonstrated resilience during the crisis, performing on average more than 7 per cent better than otherwise comparable peers. This resilience is attributed to the ability of exclusive brokers to act ambidextrously amidst crisis. Such firms could explore new business relationships while exploiting their positions in known sectors. Bothner and his colleagues found similar results when examining a second disruption, the housing crisis of 2008.

Reflecting on the broader implications of their findings, Bothner says, “In recent years we have witnessed a myriad of crises – the pandemic, various wars and conflicts, as well as market turbulence and inflation. For many firms, these crises are detrimental, but for firms occupying unique brokerage positions, opportunities for ‘generative resilience’ may well abound.”

The study stresses the importance of exclusive brokerage, despite the costs of solo bridge-building, as a springboard for sustained success in exigent circumstances. Given the escalating frequency and severity of crises, it is valuable for managers to prioritize and safeguard these exclusive relationships, ensuring they are robustly positioned for future challenges.

This research was published in the Strategic Management Journal.

Related Items

Searching for opportunities amid Trump’s tariff war crisis

Agra faces water crisis as Yamuna River on the brink of death

Encroachment Crisis: Threat to Pedestrians, Tourism, and Trade