When cash is deposited in the Banks, the anonymity of the owner of the cash disappears. The deposited cash is now identified with its owner giving rise to an inquiry, whether the amount deposited is in consonance with the depositor’s income. Accordingly, post demonetization about 1.8 million depositors has been identified for this inquiry. Many of them are being fastened with Tax and Penalties. Mere deposit of cash in a bank does not lead to a presumption that it is Tax paid Money.

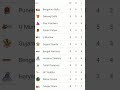

In March 2014, the number of Income Tax returns filed was 3.8 crores. In 2017-18, this figure has grown to 6.86 crores. In the last two years, when the impact of demonetization and other steps is analyzed, the Income Tax returns have increased by 19% and 25%. This is a phenomenal increase.

The number of New Returns filed post demonetization increased in the past two years by 85.51 Lakhs and 1.07 crores.

For 2018-19, advance Tax in the first quarter has increased for personal Income Tax Assesses by 44.1% and in the Corporate Tax category by 17.4%.

The Income Tax collections have increased from the 2013-14 figure of Rs.6.38 Lakh crores to the 2017-18 figure of Rs.10.02 Lakh crores.

The growth of Income Tax collections in the Pre-demonetisation two years was 6.6% and 9%. Post-demonetisation, the collections increased by 15% and 18% in the next two years. The same trend is visible in the third year.

The GST was implemented from 1st July 2017 i.e. Post demonetization. In the very first year, the number of registered assesses has increased by 72.5%. The original 66.17 Lakh assesses has increased to 114.17 Lakhs.

This is the positive impact of the Demonetisation. More formalization of the Economy, More Money in the System, Higher Tax Revenue, Higher Expenditure, Higher Growth after the first two quarters.

Related Items

People overshare their data if they think data collection is unavoidable

Watch: Inherited A Corrupt System, Says Arun Jaitley

Arun Jaitley Presents General Budget 2017-18, Total Expenditure Of ₹21.47 Lakh Crores Placed